Chip Manufacturing Node Simulator

Intel's Vertical Integration

TSMC's Foundry Model

Based on article data: TSMC typically achieves 10-15% higher yield rates than Intel at same node, and transitions to next node 2-3x faster.

Results

Back in the early 2010s, Intel was the undisputed king of chipmaking. Its processors powered nearly every laptop and desktop in the world. But today, TSMC - a company most people had never heard of a decade ago - makes more advanced chips than Intel, including the ones inside Apple’s iPhones, NVIDIA’s GPUs, and even Intel’s own next-gen CPUs. How did this happen? It wasn’t one mistake. It was a string of slow decisions, misjudged priorities, and missed opportunities that let TSMC pull ahead - and stay ahead.

Intel’s Big Bet on Vertical Integration

For decades, Intel owned every step of the chip process. It designed its own chips. It built its own factories. It even made the tools used in those factories. This model, called IDM (Integrated Device Manufacturer), worked brilliantly when Moore’s Law was easy to follow and every new generation of chips brought a 30% performance jump. But as transistors got smaller - down to 10 nanometers and below - the cost of building new factories jumped from $5 billion to over $20 billion. Intel kept betting it could afford to do everything itself. Meanwhile, TSMC focused on one thing: making chips for other companies. It didn’t design them. It didn’t market them. It just made them better, faster, and cheaper than anyone else. By 2018, Intel was stuck on 14nm technology for five years. Its 10nm chip, meant to be the next leap, kept getting delayed. TSMC, on the other hand, was already shipping 7nm chips for Apple and AMD. By 2022, TSMC was mass-producing 3nm chips. Intel still hadn’t launched a competitive 10nm product.The Foundry Model Won

TSMC didn’t invent the foundry model - it perfected it. Foundries don’t compete with their customers. They don’t make their own phones or laptops. They just make chips. That’s a huge advantage. When Apple needed a custom chip for the iPhone, it didn’t go to Intel. It went to TSMC. Why? Because TSMC had the capacity, the precision, and the track record. And when NVIDIA wanted to build its H100 AI chip, it went to TSMC. Same for Qualcomm, Broadcom, and even AMD. Intel was still trying to sell chips to the same companies that were now buying from TSMC. TSMC’s business model was simple: scale, specialize, and serve. Intel’s was: control everything. That control became a cage. Intel couldn’t pivot fast enough. When TSMC added a new production line, it could serve dozens of clients. Intel had to wait for its own designs to catch up before it could fill its own fabs.Manufacturing Precision: Nanometers and Yield Rates

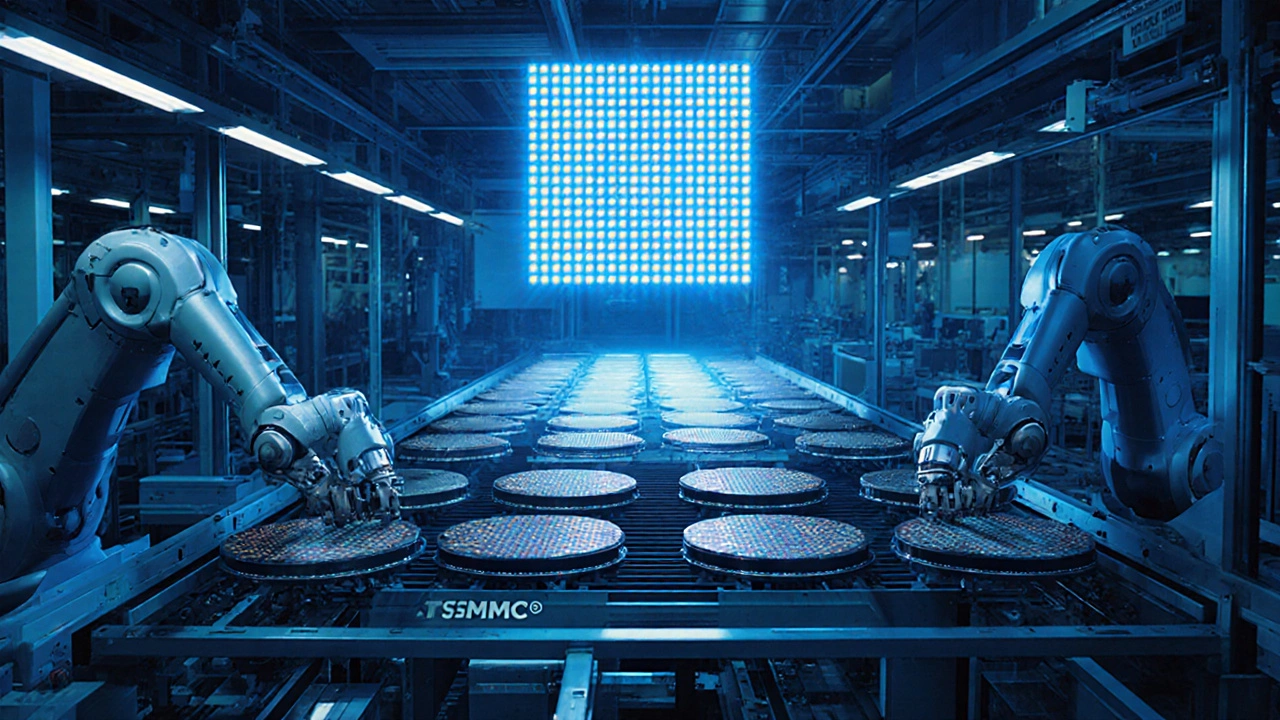

Making a chip isn’t like assembling a phone. It’s like printing a billion tiny circuits on a grain of sand - and every one has to work. The difference between 5nm and 3nm isn’t just speed. It’s power efficiency, heat, and how many chips you can pull out of a single silicon wafer. TSMC’s yield rates - the percentage of working chips per wafer - were consistently 10-15% higher than Intel’s at the same node. That might sound small, but it means TSMC could produce 20% more chips for the same cost. That’s billions in extra profit every year. Intel’s engineers were brilliant. But their focus was often on features Intel thought customers wanted - like higher clock speeds or integrated graphics - instead of pure manufacturing excellence. TSMC’s entire culture revolved around one metric: yield. Every engineer, every shift supervisor, every machine operator was measured on how many good chips they produced.

Leadership and Culture Shifts

Intel’s leadership kept changing. Between 2013 and 2021, it had five CEOs. Each one had a new vision. One pushed for mobile chips. Another wanted to break into automotive. Another focused on data centers. None stayed long enough to fix the core problem: manufacturing. TSMC’s CEO, C.C. Wei, took over in 2018 and didn’t change direction. He doubled down on R&D, hired top process engineers from around the world, and invested $100 billion over five years in new fabs. He didn’t need to be flashy. He just needed to be consistent. Intel’s internal culture was also a problem. Engineers were rewarded for innovation, not reliability. Managers pushed for new features, not better yields. There was no single metric everyone chased. TSMC had one: yield. That clarity made all the difference.The Financial Gap

TSMC made $60 billion in revenue in 2024. Intel made $53 billion - but nearly half of Intel’s revenue came from selling its own branded chips. TSMC’s entire business is manufacturing. That means it reinvests more into factories. In 2023, TSMC spent $36 billion on capital expenses. Intel spent $12 billion. That’s a three-to-one gap. TSMC built three new fabs in Arizona, Japan, and Germany. Intel is still trying to catch up with its own $20 billion U.S. government subsidy-funded projects. TSMC’s profit margin? Around 35%. Intel’s? Under 15%. That gap isn’t just about pricing. It’s about efficiency. TSMC can afford to take risks. Intel is playing defense.