Plastic Production Cost Calculator

Calculate Plastic Production Costs

Estimate how location and energy costs impact plastic resin pricing based on US industry data

Over 80 million tons of plastic are produced in the United States every year. That’s more than any other country in the Americas, and second only to China globally. But if you’ve ever wondered where all that plastic actually comes from - the bottles, bags, containers, car parts, and medical devices - you’re not alone. Most people assume it’s made in big cities or near ports. The truth? It’s scattered across the country, clustered in regions with cheap energy, skilled labor, and access to raw materials. This isn’t just about factories. It’s about supply chains, petrochemical hubs, and decades of industrial planning.

Where Most Plastic Is Made in the US

The heart of American plastic production lies in the Chemical Corridor - a 150-mile stretch along the Mississippi River between Baton Rouge, Louisiana, and Houston, Texas. This area is home to over 40% of the nation’s plastic manufacturing capacity. Why here? Because it’s where natural gas and crude oil are processed into ethylene and propylene - the building blocks of most plastics. Companies like Dow, ExxonMobil, and Shell operate massive integrated plants here that turn raw hydrocarbons into pellets, which then get shipped to other factories across the country.

But plastic isn’t just made in Louisiana and Texas. Other major hubs include:

- Pennsylvania and Ohio - thanks to the Marcellus and Utica shale plays, these states have seen a surge in new plastic plants since 2018. Companies like Eastman Chemical and NOVA Chemicals have expanded here to take advantage of low-cost ethane from fracking.

- Alabama and Mississippi - the Gulf Coast extension, with new facilities from INEOS and LyondellBasell, now rival Texas in output.

- California - despite strict environmental rules, it still produces high-value specialty plastics for medical, electronics, and packaging industries. Companies like Amcor and Berry Global operate major plants here.

- Illinois and Indiana - these states focus on injection molding and thermoforming, turning pellets into finished products like food containers, toys, and automotive parts.

According to the American Chemistry Council, over 70% of plastic resin production in the U.S. happens in just five states: Texas, Louisiana, Pennsylvania, Ohio, and Alabama. These states don’t just make plastic - they control the entire pipeline from raw material to final product.

Major Plastic Manufacturing Companies in the US

It’s not just location that matters - it’s who’s running the plants. Here are the top five companies driving plastic production in the U.S. today:

- Dow Inc. - Based in Midland, Michigan, Dow operates 18 major manufacturing sites across the U.S. and is the largest producer of polyethylene and polypropylene in North America. Their Texas and Louisiana plants alone produce over 10 million tons of plastic resin annually.

- ExxonMobil - Their Baytown, Texas facility is the largest single-site plastic manufacturing complex in the world. It produces 3.5 million tons of polyethylene each year, mostly for packaging films and bottles.

- Shell Chemical - Their new $6 billion ethane cracker in Pennsylvania, opened in 2022, is the most advanced plastic plant in the country. It’s designed to convert local natural gas into 1.6 million tons of ethylene per year.

- LyondellBasell - With plants in Houston, Pasadena, and Corpus Christi, they’re the top producer of polypropylene in the U.S. Their products go into car parts, medical syringes, and food containers.

- INEOS - Though headquartered in Europe, INEOS has invested over $5 billion in U.S. plastic manufacturing since 2015. Their new facility in Calvert City, Kentucky, produces 1.2 million tons of vinyl chloride monomer annually - the base for PVC pipes and siding.

These companies don’t just make raw plastic. They work with hundreds of smaller converters - companies that take pellets and turn them into actual products. For example, a bottle cap might be molded by a small factory in Wisconsin, but the plastic resin inside came from a Dow plant in Texas.

How Plastic Gets From Plant to Product

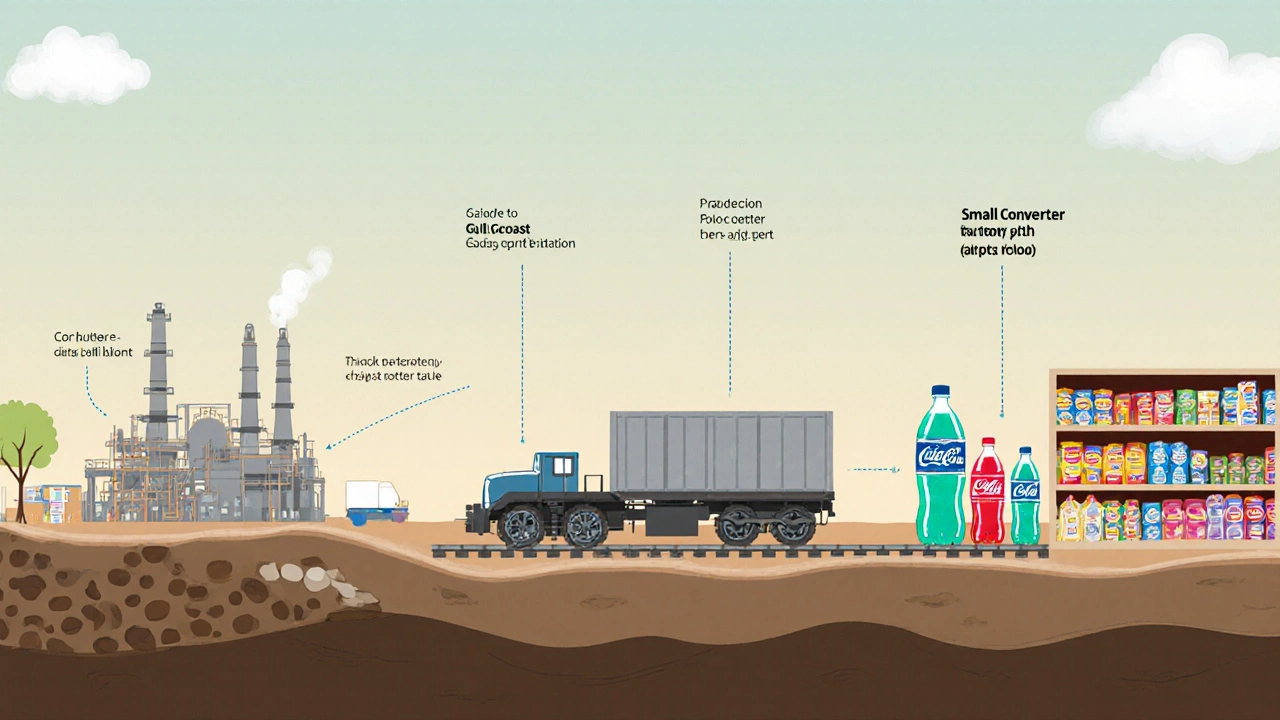

Understanding where plastic is made means understanding the two-stage process: resin production and conversion.

First, resin production happens at massive petrochemical plants. Natural gas or crude oil is broken down into ethylene or propylene, then polymerized into pellets - tiny beads of plastic. These pellets are shipped by rail or truck to conversion facilities.

Second, conversion takes place in thousands of smaller factories. These use machines like injection molders, extruders, and blow molders to shape pellets into bottles, containers, toys, or car bumpers. These converters are often located near their customers - a food packaging plant might be near a grocery distribution center, while an auto parts maker is near an assembly plant.

This separation is key. You won’t find a single factory making a soda bottle from oil. Instead, you’ll find a petrochemical plant in Louisiana making pellets, a converter in Georgia turning them into bottles, and a bottling plant in California filling them with soda. The plastic’s journey is long, but it’s all connected.

Why These Locations? Energy, Water, and Regulation

Plastic manufacturing isn’t random. It follows three rules: cheap energy, water access, and relaxed regulations.

Energy is the biggest factor. Making plastic requires extreme heat - up to 1,500°F in cracker furnaces. Natural gas is the cheapest fuel, and states with abundant shale gas (Texas, Pennsylvania, Ohio) have a massive cost advantage. Electricity prices in Louisiana are 30% lower than in California, which directly affects production costs.

Water is needed for cooling and chemical processes. Plants near rivers or coasts have easier access to water, which is why most are clustered along the Gulf Coast or Great Lakes.

Regulation plays a big role too. States like Texas and Louisiana have streamlined permitting for industrial projects. Environmental reviews take months, not years. California, by contrast, has strict air quality rules and lengthy approval processes. That’s why new plastic plants rarely open on the West Coast - the cost and delay make it unprofitable.

What’s Changing in the US Plastic Industry

The plastic industry is shifting fast. Since 2020, over $200 billion has been invested in new U.S. plastic plants - mostly in the Gulf and Appalachia. This boom is driven by three trends:

- Fracking - cheap natural gas from shale has made U.S. plastic cheaper than imports from Asia.

- Supply chain reshoring - after pandemic disruptions, companies like Walmart and Procter & Gamble are moving plastic sourcing back to the U.S. to avoid port delays.

- Recycling tech - new chemical recycling plants in Ohio and Illinois are starting to turn used plastic back into raw material, reducing the need for virgin resin.

But there’s also pressure. Over 60% of Americans now support bans on single-use plastics. Cities like San Francisco and Seattle have banned plastic straws and bags. Some manufacturers are responding by switching to bioplastics or designing for reuse. But for now, most new investment still goes into traditional plastic - because demand hasn’t dropped.

What This Means for Consumers and Businesses

If you’re buying plastic products in the U.S., chances are the plastic inside was made in Texas, Louisiana, or Pennsylvania - even if the final product was assembled in Michigan or North Carolina. This matters because:

- Prices - Plastic prices rise when energy costs climb. If natural gas spikes, your shampoo bottle or yogurt cup will cost more.

- Supply - A hurricane in the Gulf Coast can shut down multiple plants. That’s what happened in 2022 when Hurricane Ian disrupted 30% of U.S. plastic output - leading to nationwide shortages of food packaging.

- Quality - Plastics made in the U.S. meet stricter safety standards than many imports. Medical devices and baby bottles made here are held to FDA and ASTM standards.

For businesses, sourcing plastic locally means faster delivery, better control over quality, and fewer supply chain risks. That’s why more companies are now choosing U.S.-made resin over cheaper imports from China or the Middle East.

FAQ

Where is most plastic made in the United States?

Most plastic in the U.S. is made in the Chemical Corridor along the Gulf Coast - especially in Texas and Louisiana. These states have the largest concentration of petrochemical plants that turn natural gas and oil into plastic pellets. Together, they produce over 40% of the nation’s plastic resin. Other major hubs include Pennsylvania, Ohio, and Alabama, thanks to cheap shale gas and new investments.

Which companies make the most plastic in the US?

Dow Inc., ExxonMobil, Shell Chemical, LyondellBasell, and INEOS are the top five plastic producers in the U.S. Dow and ExxonMobil lead in polyethylene production, while Shell’s new Pennsylvania plant is the most advanced ethane cracker in the country. These companies supply the raw plastic pellets that thousands of smaller manufacturers turn into everyday products.

Is plastic made in California?

Yes, but not at the same scale as the Gulf Coast. California still has major plastic converters that make medical devices, electronics casings, and specialty packaging. However, it has almost no new resin plants due to strict environmental regulations and high energy costs. Most plastic used in California is shipped in from Texas or Louisiana.

Why is plastic production concentrated in the South?

Three reasons: cheap natural gas from fracking, access to water for cooling, and less restrictive permitting. States like Texas and Louisiana offer faster approvals and lower taxes for industrial projects. Energy costs are also significantly lower than in the Northeast or West Coast, making production far more profitable.

Are U.S.-made plastics safer than imported ones?

Generally, yes. U.S.-made plastics for food packaging, medical devices, and children’s products must meet strict FDA and ASTM standards. Many imported plastics, especially from countries with weaker regulations, contain additives or contaminants that are banned here. If you’re buying baby bottles, food containers, or pharmaceutical packaging, U.S.-made plastic is more likely to be safe.