IKEA India Profitability Calculator

This calculator estimates IKEA's profit margin in India based on key variables from the article. Adjust values to see how changes impact profitability.

Current Profitability

Projected Profitability

Key Takeaways

- IKEA generated roughly $800million in revenue from India in FY2024, but net profit was under 1% of that amount.

- Local sourcing now makes up about 30% of IKEA India's product mix, cutting import duties and boosting margins.

- Tier‑2 and Tier‑3 city expansion, plus a stronger e‑commerce platform, are the main levers for future growth.

- High real‑estate costs and complex tax rules remain the biggest profitability hurdles.

- Compared with Indian‑homegrown rivals, IKEA’s profit margin lags, but its brand power secures a steady traffic flow.

When you hear "IKEA" you picture flat‑pack furniture, Swedish‑blue‑yellow stores and a tiny meatball menu. IKEA is a multinational home‑goods retailer that operates in 52 countries and follows a cost‑leadership business model built around self‑assembly, large‑scale sourcing and a standardized store layout. In India, the story is a bit different. IKEA India launched its first store in Hyderabad in 2018 and now runs 12 megastore locations plus a growing online channel. The question on everyone’s mind: IKEA India profit - is the Swede actually making money here?

Financial Snapshot - FY2024

According to the InterIKEA Group annual report (2024) and Reuters filings, the Indian operation recorded $800million in revenue. That number represents roughly 1.8% of the group’s total turnover (about $45billion). However, net profit from India was reported at $6.5million - a margin of just 0.8%.

Why the thin margin? The bulk of the revenue comes from high‑traffic stores that still carry a significant share of imported goods. Import duties on wood, metal and textiles range from 10% to 30%, eroding the cost advantage IKEA typically enjoys in Europe and North America.

Revenue Breakdown

- Store sales: 68% of total revenue - driven by flagship megastores in metros.

- Online sales: 22% - IKEA’s e‑commerce platform grew 45% YoY after the 2023 app redesign.

- Services: 10% - includes assembly, home delivery and extended warranty packages.

The service line is the only segment where profit margin exceeds 5%, thanks to relatively low variable costs.

Cost Structure - Where the Money Goes

Understanding IKEA’s cost drivers in India helps explain the profit gap.

- Import duties add an average of 18% to product cost.

- Real‑estate expenses rank among the highest in the country, with megastores leasing 20,000‑30,000sqm at prime city‑center rates.

- Logistics costs are inflated by a fragmented Indian road network, pushing freight rates up by 12% compared with Europe.

- Local sourcing currently covers only 30% of SKU mix; the remaining 70% are still imported.

When IKEA accelerates local sourcing, it trims the duty line, shortens the supply chain and improves margins.

Indian Furniture Market - The Bigger Picture

The Indian furniture sector was valued at $65billion in 2024 and is projected to hit $100billion by 2030, growing at a CAGR of 12%.

Key growth drivers include a rising middle class (over 350million households), urbanisation, and an increasing appetite for stylish yet affordable home solutions. Foreign Direct Investment (FDI) in the retail furniture segment reached $1.2billion in 2023, indicating strong confidence from overseas players.

In this booming market, IKEA’s brand equity gives it a steady stream of foot traffic, but the competition is fierce.

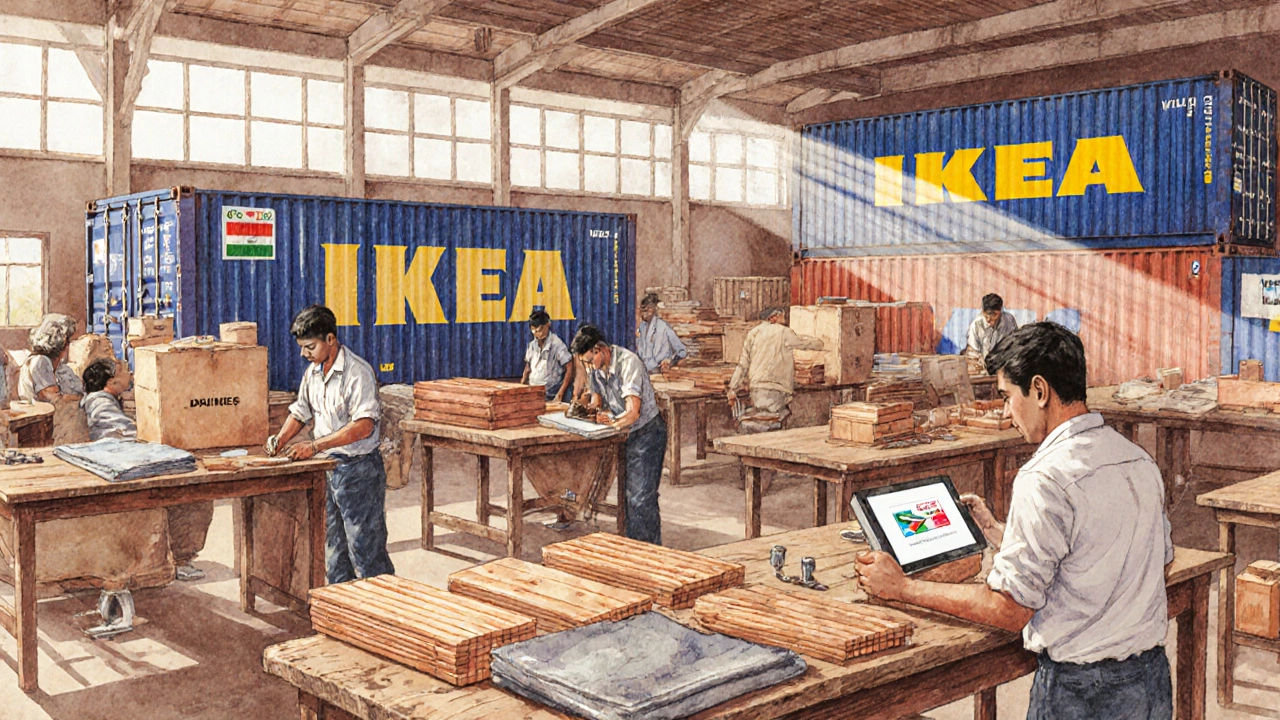

Supply Chain & Local Sourcing Strategy

Since 2021, IKEA has signed agreements with more than 200 Indian manufacturers, covering wood, metal, textile and packaging. The goal is to push the locally sourced share from 30% (2024) to 45% by 2027.

Local sourcing delivers three tangible benefits:

- Reduces import duty exposure by up to 25% per item.

- Shortens lead time from 90days to 45days for 60% of the catalog.

- Strengthens the “IKEA sustainability” narrative, which resonates with Indian millennials.

However, many Indian suppliers still struggle with mass‑production standards, so IKEA invests heavily in training and technology transfer.

Consumer Behaviour Insights

Indian shoppers prioritize three things: price, durability and style. The flat‑pack model checks all three, but the assembly step can be a pain point. To address this, IKEA introduced “Self‑Assembly Assist” kiosks in 2023, where staff walk customers through the first few steps.

Online shoppers, especially in Tier‑2 cities, favor the “click‑and‑collect” option, which combines low delivery cost with quick pickup. This hybrid model contributed to a 37% increase in order value for online channels in FY2024.

Challenges Dragging Profitability

- Real‑estate premium: Leasing mega‑stores in metro hubs costs up to $150/sqm per year, far above the global average of $60/sqm.

- Tax complexity: The Goods and Services Tax (GST) structure imposes a 5% surcharge on imported furniture, adding to cost.

- Regulatory hurdles: The “single‑brand retail” rule limits the number of large‑format stores a foreign retailer can open without a local partner.

- Supply‑chain bottlenecks: Seasonal monsoons disrupt road transport, causing occasional stockouts.

These factors collectively shave off roughly 2% of gross margin each year.

Outlook - Where Is IKEA Heading in India?

Management’s 2025 strategic plan focuses on three pillars:

- Geographic expansion: Open 6 new megastores in Tier‑2 cities (e.g., Pune, Ahmedabad) by 2027.

- Supply‑chain localisation: Raise the locally sourced product share to 45% and launch a “Made‑in‑India” label for 150 SKU.

- Omnichannel integration: Roll out a unified app that merges in‑store navigation, AR‑based room visualisation and same‑day delivery in metro clusters.

If these levers work, analysts from Morgan Stanley project IKEA India’s profit margin could climb to 2‑3% by 2028, still below the group average of 5% but enough to make the Indian arm a genuine profit centre.

How IKEA Stacks Up Against Home‑grown Rivals

| Brand | Year Entered India | Store Count (incl. Online) | Estimated Revenue (FY2024) | Profit Margin |

|---|---|---|---|---|

| IKEA | 2018 | 12 megastores + online | $800million | 0.8% |

| Urban Ladder | 2012 | Online only (220k SKUs) | $350million | 2.5% |

| Pepperfry | 2015 | Online + 15 experience centres | $420million | 1.8% |

Even though IKEA’s profit margin trails its local competitors, its absolute revenue is more than double, thanks to the high‑ticket average per transaction ($120 vs $70‑$80 for the others).

Bottom Line - Is IKEA Making Money in India?

Short answer: Yes, but not the kind of money you’d expect from a classic IKEA store. The Indian operation is cash‑flow positive, but net profit is still under 1% of sales. The upside hinges on deeper local sourcing, smarter real‑estate tactics and a push into smaller cities.

For investors and entrepreneurs eyeing the Indian retail space, IKEA’s experience offers a clear lesson: brand power opens the door, but cost discipline and supply‑chain localisation close the deal.

Frequently Asked Questions

What was IKEA’s total revenue from India in FY2024?

IKEA India generated about $800million in revenue during the 2024 fiscal year.

How much of IKEA’s product range is locally sourced in India?

As of 2024, roughly 30% of SKUs sold in Indian stores are made by Indian suppliers. The target is 45% by 2027.

Which cities host IKEA’s megastores?

Current megastore locations include Hyderabad, Mumbai, Bengaluru, Delhi, Chennai, Pune, Jaipur, Kolkata, Ahmedabad, Surat, Lucknow and Noida.

What are the biggest challenges to profitability for IKEA in India?

High real‑estate costs, import duties on non‑local goods, complex GST rules, and supply‑chain disruptions during monsoon season are the primary hurdles.

How does IKEA’s profit margin compare with Indian competitors?

IKEA’s margin sits at about 0.8%, while home‑grown platforms like Urban Ladder and Pepperfry enjoy 2‑3% margins, thanks to lower overhead and fully local supply chains.