Manufacturing Value Calculator

US Manufacturing Output Comparison

The US leads in high-value manufacturing but trails China in total volume. See how the value of your inputs compares to global manufacturing impact.

Results

US Manufacturing Value

$0 billion

vs China's $4.8 trillion volume

Economic Multiplier Effect

Every dollar in manufacturing creates $1.4 in other economic sectors.

US High-Value Share

US leads in high-value manufacturing (40% of global high-tech output)

Workforce Impact

Creating 0 new manufacturing jobs

For years, the US has been called the world’s manufacturing powerhouse. But today, that label doesn’t tell the whole story. If you look at raw output, the US isn’t number one anymore. It hasn’t been for over a decade. So what’s really going on? And why does it matter if the government keeps pushing policies to bring factories back?

China Makes More Than the US - by a Lot

In 2024, China produced about $4.8 trillion worth of manufactured goods. The US came in second at $2.3 trillion. That’s less than half. The gap isn’t closing. It’s growing. China’s manufacturing output has more than doubled since 2010. The US has barely grown 15% in the same period.

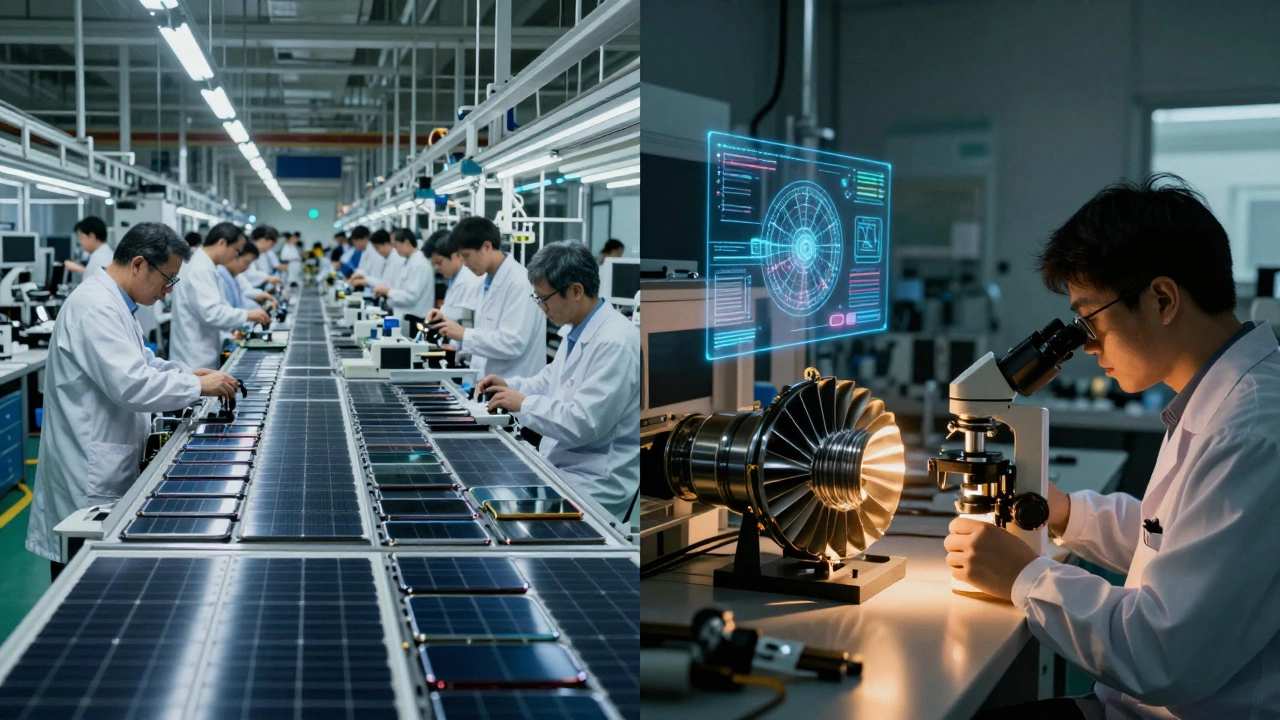

This isn’t about factories being empty. It’s about volume. China makes more smartphones, solar panels, electric vehicles, and textiles than every other country combined. It’s not just cheap labor anymore - it’s scale, supply chains, and government coordination. The Chinese government poured over $1.5 trillion into industrial upgrades since 2015. Factories there don’t just assemble parts. They design them, make the chips inside them, and ship them out the same day.

The US Still Leads in High-Value Manufacturing

But here’s where the story flips. The US doesn’t win by quantity - it wins by value. American factories produce the most expensive stuff on the planet. Jet engines. Medical devices. Semiconductor equipment. Defense tech. A single F-35 fighter jet costs $85 million. A single MRI machine from GE or Siemens sells for over $1 million. These aren’t mass-market items. They’re precision-engineered, high-margin products that require advanced R&D and skilled labor.

The US accounts for nearly 40% of global high-tech manufacturing output. That’s more than Germany, Japan, and South Korea combined. Boeing, Lockheed Martin, Medtronic, and Applied Materials don’t compete on price. They compete on innovation. And that’s where the US still holds the edge.

Government Schemes Are Trying to Shift the Balance

The CHIPS and Science Act of 2022 is the biggest federal manufacturing push in decades. It allocated $52 billion to bring semiconductor production back to the US. So far, companies like Intel, TSMC, and Samsung have pledged over $200 billion in new investments. New fabs are rising in Ohio, Arizona, and Texas. But building a chip plant takes five years. And even when they’re done, they won’t match the scale of Taiwan or South Korea.

The Inflation Reduction Act added another $370 billion for clean energy manufacturing. Solar panel factories. Battery plants. Wind turbine makers. All of them getting tax credits if they use American-made parts. The goal? Cut reliance on China for green tech. But here’s the catch: the US still imports 80% of its solar panels. Most of them come from Southeast Asia - not China directly, but made with Chinese equipment and materials.

These programs aren’t magic. They’re subsidies. They help, but they don’t rebuild entire supply chains overnight. The US lost its low-cost manufacturing base decades ago. Rebuilding it means paying higher wages, higher energy costs, and higher regulatory fees. That’s why most new factories are automated - fewer workers, more robots.

Why the US Still Needs Manufacturing - Even If It’s Not #1

Manufacturing isn’t just about making things. It’s about innovation, jobs, and national security. Every dollar spent in manufacturing creates $1.40 in other parts of the economy. That’s higher than any other sector. Factories drive demand for logistics, engineering, software, and maintenance. They train workers in advanced skills. They’re the backbone of supply chain resilience.

During the pandemic, the US ran out of masks, ventilators, and even syringes because most were made overseas. That scared policymakers. Now, the government is pushing for “friend-shoring” - moving production to allies like Mexico, India, or Vietnam. But those countries don’t have the capacity to replace China yet. And they’re not as reliable as domestic production.

That’s why the US isn’t trying to win the quantity race. It’s trying to win the quality race. The goal isn’t to make 100 million T-shirts. It’s to make the machines that make the T-shirts - and control the technology behind them.

What the Numbers Don’t Show: The Workforce Gap

One of the biggest myths is that the US lost manufacturing because workers quit. The truth? There aren’t enough skilled workers to fill the jobs. There are over 800,000 open manufacturing jobs in the US right now. Companies can’t find machinists, CNC operators, automation technicians, or quality control engineers.

High schools stopped teaching shop class. Community colleges don’t have the funding. Apprenticeships are rare. Meanwhile, countries like Germany and Japan have had strong vocational systems for decades. Their workers can fix a $2 million CNC machine before breakfast. The US is trying to catch up with programs like the Manufacturing USA network - 16 institutes across the country training workers in advanced materials, robotics, and AI-driven production. But it’s a slow process.

Without fixing the skills gap, no amount of government money will bring manufacturing back. You can build a factory, but if no one can run it, it sits empty.

Who’s Really Winning in Global Manufacturing?

China leads in volume. The US leads in value. But other players are rising fast.

Germany makes the world’s most precise machinery. It exports $1.1 trillion in manufactured goods - more than Japan or South Korea. Its Mittelstand companies - small, family-owned factories - are hidden champions. They make everything from specialized bearings to medical laser systems. No one else can replicate their precision.

Mexico is becoming the US’s closest manufacturing partner. It’s the top supplier of auto parts to the US. Its proximity, lower labor costs, and USMCA trade rules make it ideal for nearshoring. Over 1,200 new factories opened in Mexico between 2020 and 2024.

India is pushing hard. Its Production Linked Incentive (PLI) scheme has drawn over $20 billion in investments for electronics and pharma. It’s not ready to beat China yet, but it’s building the infrastructure fast.

The US isn’t losing. It’s redefining what winning looks like.

The Real Question Isn’t Who Makes the Most - It’s Who Controls the Future

Manufacturing isn’t just about steel and silicon anymore. It’s about control. Who designs the AI that runs the factory? Who owns the patents on the next-generation battery? Who can produce critical minerals without relying on hostile nations?

The US may not make the most smartphones. But it makes the chips inside them. It doesn’t assemble the most EVs. But it develops the battery chemistry that powers them. It doesn’t print the most circuit boards. But it designs the software that makes them work.

That’s the new game. And in this game, the US still leads.

Can the US Ever Be #1 Again?

Probably not - and it doesn’t need to be. The goal isn’t to outproduce China in quantity. It’s to out-innovate in quality. To build factories that are smarter, cleaner, and more automated. To train a workforce that can handle the machines of tomorrow. To make sure the next big breakthrough - whether it’s fusion energy, quantum computing, or synthetic biology - starts in a US lab and ends in a US factory.

The government schemes aren’t about nostalgia. They’re about survival. The world is changing fast. The next decade will be won by the countries that control the tools of production - not just the volume of output.

The US isn’t the biggest manufacturer anymore. But it’s still the most influential one.

Is the US still a major manufacturer?

Yes, the US is still a major manufacturer - but not the largest by volume. It ranks second globally in total output, behind China. However, it leads the world in high-value manufacturing, producing advanced goods like jet engines, medical devices, and semiconductor equipment that command premium prices and drive innovation.

Why does China produce more than the US?

China produces more because of massive scale, government-backed industrial planning, and decades of investment in supply chains. It makes everything from consumer electronics to solar panels in enormous volumes, often at lower costs. Its factories are integrated, efficient, and supported by state policies that prioritize manufacturing growth over other sectors.

What are the key US government manufacturing programs?

The two biggest are the CHIPS and Science Act, which provides $52 billion to boost semiconductor production, and the Inflation Reduction Act, which offers $370 billion in incentives for clean energy manufacturing. Both aim to reduce dependence on foreign supply chains and bring high-tech production back to the US through tax credits, grants, and public-private partnerships.

Why are there so many open manufacturing jobs in the US?

There are over 800,000 open manufacturing jobs because the industry has shifted toward automation and advanced technology, but the workforce hasn’t kept up. Schools have cut vocational training, apprenticeships are rare, and many workers lack skills in robotics, CNC operation, and industrial AI. The US is trying to fix this through Manufacturing USA institutes and community college partnerships.

Is nearshoring to Mexico replacing China for US manufacturers?

Mexico is becoming a major alternative, especially for automotive parts and electronics. Over 1,200 new factories opened there between 2020 and 2024, thanks to lower costs, proximity, and USMCA trade rules. But it hasn’t replaced China yet - Mexico lacks the scale and depth of supply chains. It’s a complement, not a full substitute.

Can the US ever surpass China in manufacturing output?

It’s unlikely the US will surpass China in total output. China’s infrastructure, workforce size, and government coordination make that nearly impossible. But the US doesn’t need to. Its strategy is to lead in high-value, high-tech manufacturing where innovation, not volume, determines dominance.